If you are laser-focused on the bottom line only, little positive happened in Q2. Consider the two most important metrics: FGAUM (fee-generating AUM) has grown from $175B to $177B during the quarter, or approximately 1%. Non-GAAP DE (distributable earnings) per share was $0.21 in Q2 25 vs. $0.19 in Q2 24—10% up, which is weak for an alt manager.

Blue Owl (OWL) today is similar to a coiled spring that will begin releasing energy shortly. Over the next 18-24 months, this burst of energy should be sufficient to propel the shares much higher than the ~$19 they are trading at today. Given OWL's extreme volatility, I do not want to guess its trading range two years from now. But just consider that it was trading at similar levels about a year ago, before the transformational acquisitions in the second half of 2024 and strong organic growth. Earlier this year, the stock was at ~$26. Historically, Owl has compounded at 25-27% annually, including dividends, over its relatively short public history, and I do not see anything that would prevent it from continuing this trajectory. On the contrary, but investors have to tolerate volatility and use it to their advantage.

This post revisits and develops themes of my “Blue Owl’s Treasure Island - Update”. As usual, if you are new to alt managers, please read my free “Primer on alternative asset managers”, since I will assume certain familiarity with the industry. Before we start, I will remind you of the distinctive features of Owl’s business model - arguably the best within the alternative asset management space.

The model is FRE-centric. Fee revenues consist almost exclusively of recurring management fees that are predictably growing. OWL does not have any traditional private equity business and does not depend on fickle carry.

Even though OWL is much smaller than the biggest companies in the industry, its FRE margins of ~60% are second to none.

To remain FRE-centric and asset-light, OWL pays out almost all of its cash flows in dividends.

Close to 90% of OWL's AUM is permanent. Permanent capital under management does not have a contractual expiration date and seldom leaves the system. Each round of fundraising keeps adding to AUM without outflows.

OWL has three carefully selected segments they keep expanding through adjacent strategies and acquisitions: credit, GP Strategic Capital (investing in other private capital managers), and Real Assets (real estate and infrastructure, including data centers).

OWL is asset-light to the extreme. About 80% of their assets are deferred tax assets, intangibles, and goodwill. It does not face direct risks to its capital as it invests close to zero in the vehicles it manages.

The structure of its assets shields OWL’s income from taxes, and it enjoys a cash tax rate much lower than the statutory 21%. This is expected to be the case for the next several years.

From the very beginning, OWL pursued business from both institutional and retail (aka, wealth) channels at almost equal proportions. In the retail channel, it is the second or third biggest player.

OWL is not directly exposed to foreign assets or to trade issues.

Acquisitions are not accretive yet.

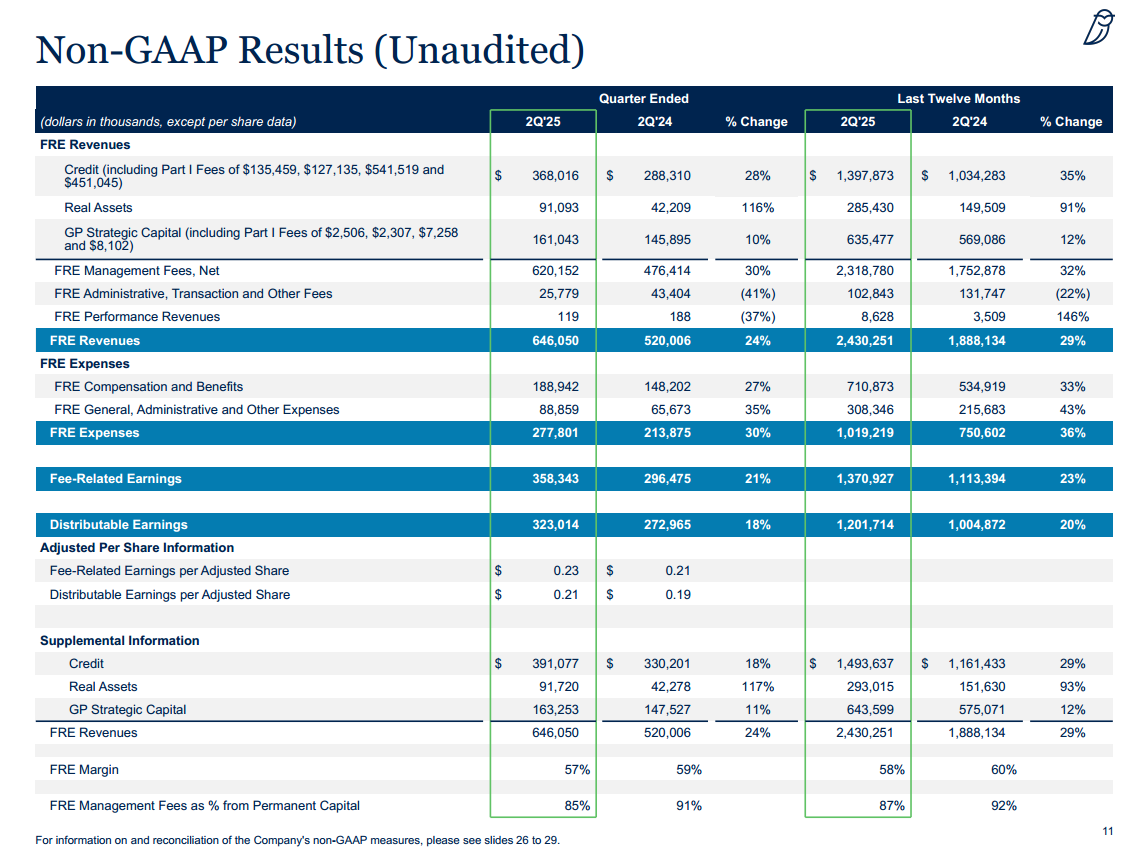

To have a reference point, I will paste Owl’s non-GAAP numbers from their presentation.

In the period between June 6, 2024, and Jan 3, 2025, Owl executed four acquisitions—Prima for real estate credit, Atalaya for alternative credit, Kuvare for insurance strategies, and IPI for digital infrastructure. All of them are experienced players in their niches and introduce new strategies to Owl’s arsenal. Among them, IPI is the latest and the most significant.

Acquisition costs have entered Owl’s numbers in three ways. First, interest expense is up. In Q2 25, interest expense was $42M vs $33M a year ago. Since Owl’s quarterly FRE is $323M this is the least important.