Why Is Apollo So Optimistic?

The Q3 results spoke clearly — and Apollo’s leadership sounded even more assured.

Apollo’s ($APO) Q3 was strong. However, its earnings call was even more revealing, emphasizing far-reaching consequences. We’ll begin with the quarterly results, proceed with valuation, and then highlight and comment on parts of the earnings call where Apollo’s executives projected confidence that went beyond the usual upbeat tone.

I continue to hold my shares, but for those without a position or with a small one, it might be the right time to initiate/increase their exposure.

For new readers, I have to mention that Apollo is an alternative asset manager, formerly known as private equity, which reports in three segments:

Asset management consists primarily of management and transaction fees. Credit assets represent the vast majority of its AUM and dominate fee-related earnings (FRE). Apollo’s private equity business is smaller.

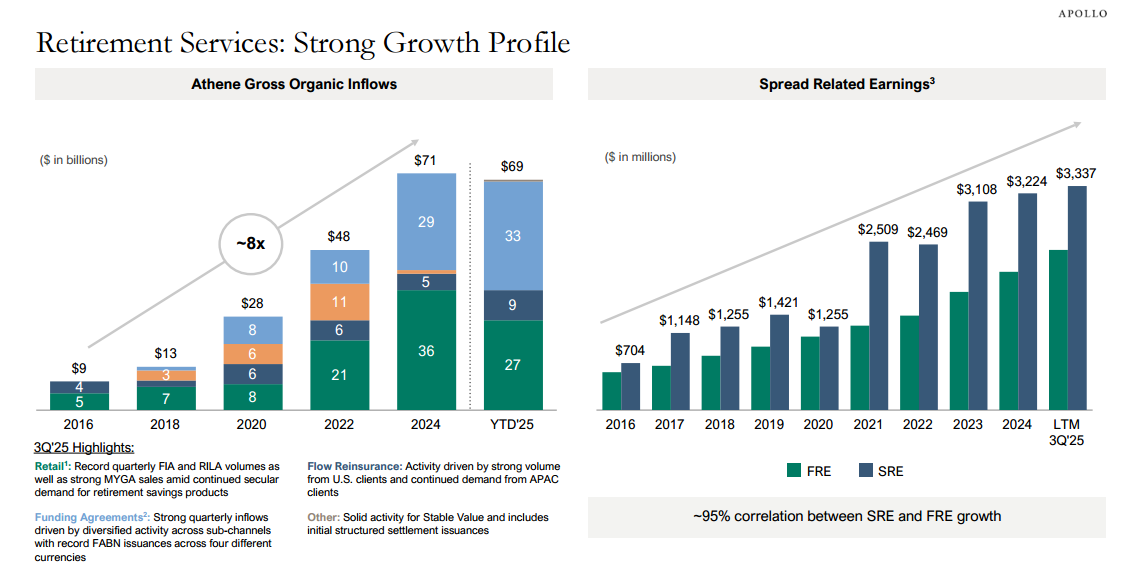

Retirement services consist of its big life insurance subsidiary, Athene, which writes fixed annuities and similar products, including fixed-indexed annuities, fixed annuities reinsurance, group annuities, aka pension risk transfer, and funding agreements. Athene’s non-GAAP results are coming from spreads, and hence are called spread-related earnings (SRE). Today, SRE is the biggest contributor to Adjusted Net Income (ANI).

Principal Investing Income (PII) consists mostly of carry. In certain quarters, PII may be material, but it is usually small and fickle. Accordingly, it deserves only low multiples, and its contribution to Apollo’s value is way below that of FRE or SRE. In recent quarters, PII’s contribution was barely noticeable, as it is dependent on carry realization, which in its turn depends on IPOs. The IPO market has been almost frozen until recently.

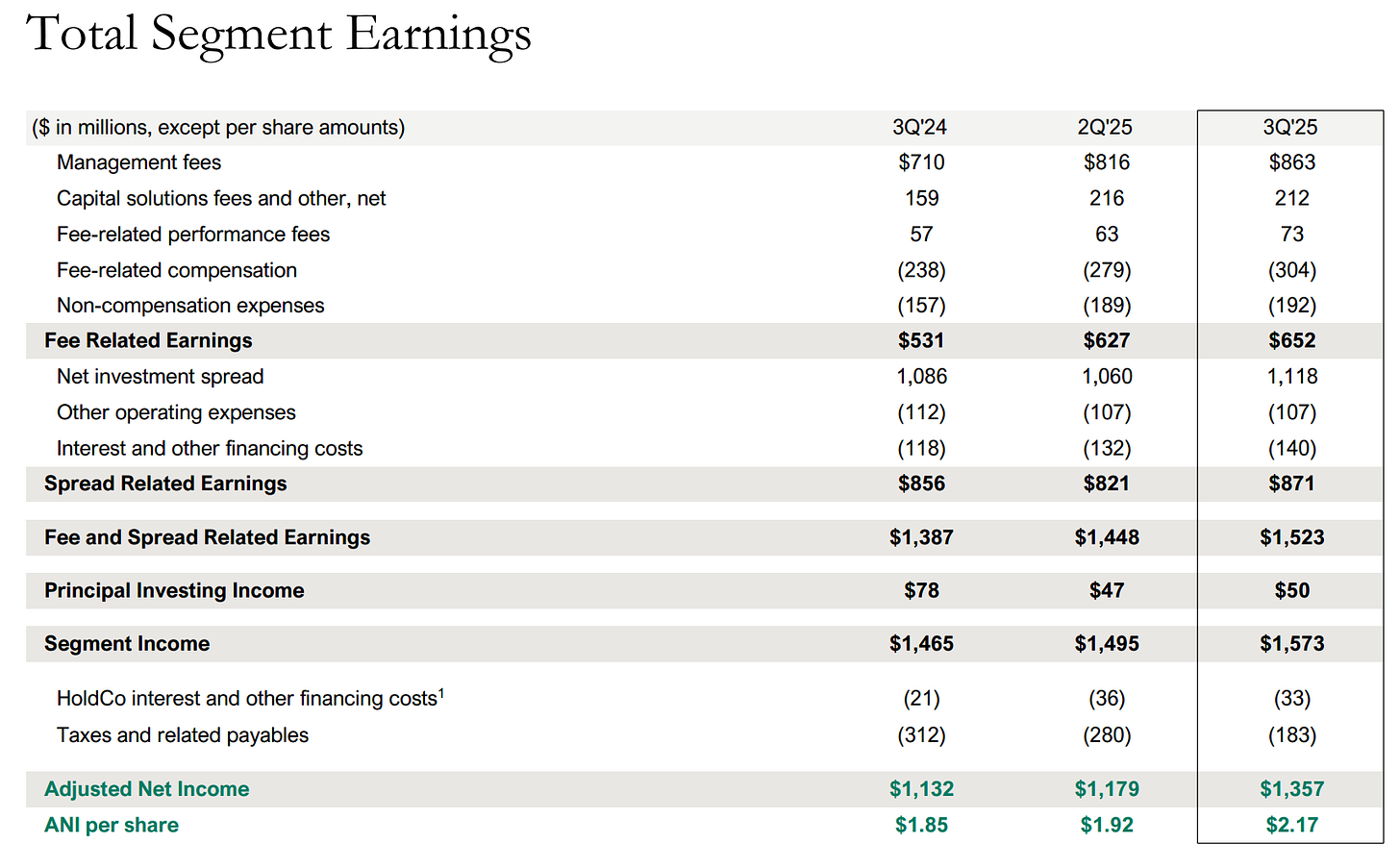

The sum of FRE, SRE, and PII, less financing costs and taxes, forms ANI, which many investors consider the most important metric.

The results

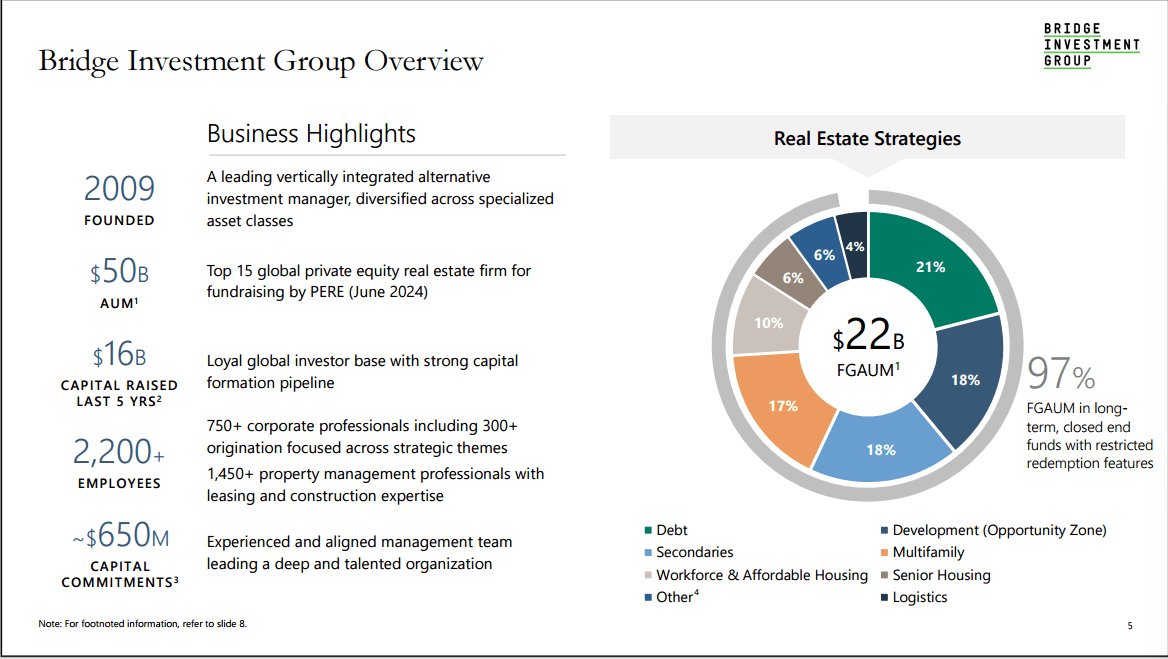

Several developments predicted a successful quarter. On September 2, Apollo closed the accretive acquisition of Bridge Investments, including its $22B of FGAUM (fee-generating AUM), and would benefit from it both in Q3 (albeit for one month only) and the longer term. The acquisition will materially increase Apollo’s presence in real estate in both equity and credit.

Secondly, Athene’s operating spread was compressed in recent quarters, partly due to the shifting in its fixed-income portfolio from floating- to fixed-rate exposure. This process was mostly finished in Q2.

The results were better than expectations. The progress was obvious in both yoy and qoq metrics.

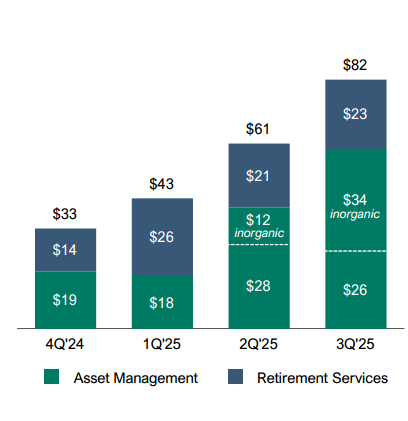

Both FRE and SRE were noticeably higher in Q3, PII was non-significant, and little changed. ANI jumped 13% qoq.

Note the increase in fee revenues from all kinds of fees - management fees, capital solution fees, and fee-related performance fees. Management fees are proportional to FGAUM. Capital solutions fees are primarily transactional fees, driven mostly by origination activities. Fee-related performance fees are still relatively small but grow particularly fast. They are incentive-type fees generated from perpetual or open-ended vehicles that do not operate like traditional closed-end private equity funds. Many of these vehicles are for the wealth channel, which we will review shortly.

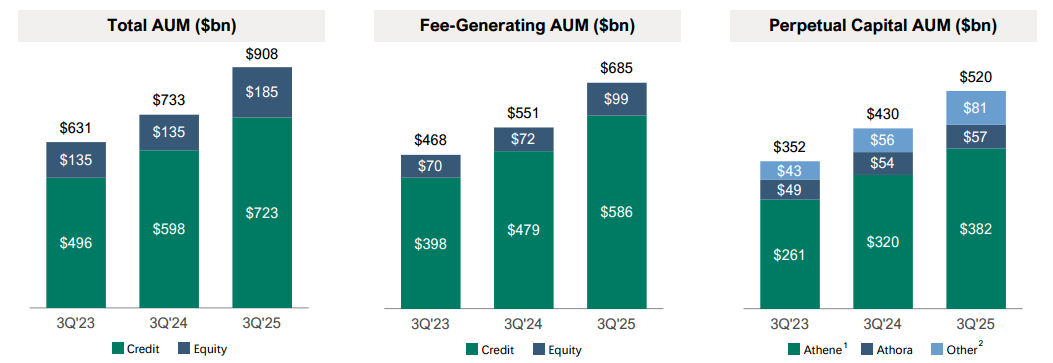

On a yoy basis, the progress in FRE and related AUM and FGAUM was impressive, though partially attributable to the Bridge acquisition.

Most of the increase in AUM/FGAUM was due to high, near-record organic inflows in Q3. The slide below shows quarterly inflows to AUM.

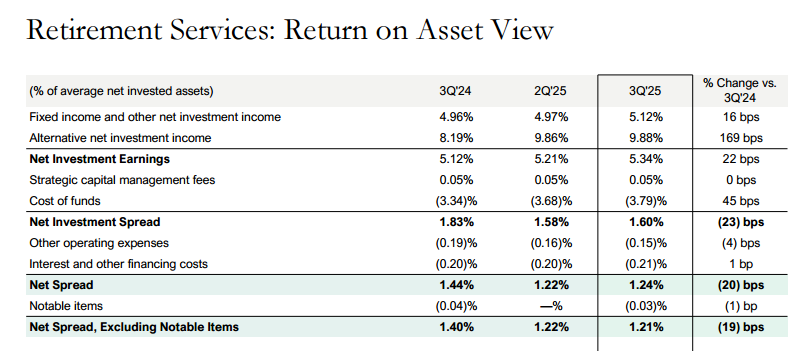

For the Retirement Services segment, SRE has grown due to both an increase in the invested assets and a slight expansion in spread (SRE is the product of average invested assets and operating spread). While the former is easily predictable, the latter fluctuates from quarter to quarter within a rather narrow range. Here are the results for the operating spread (ROA is synonymous with the operating spread for Athene).

Inflows to Athene remain very high and for three quarters of 2025, have reached the level of full 2024!