Understanding Legal & General (LGEN in London, LGGNY, and LGGNF) is not a trivial matter. One has to dissect arcane accounting based on mind-boggling assumptions across two accounting standards, multiplied by three business segments. During the last earnings call, similar to previous ones, only LGEN’s CFO (among 5 people on stage) had to answer most of the questions… I apologize in advance for certain (over)simplifications I will make in this post.

LGEN is still very much worth your time. Different from other high-yielding stocks, it has the potential for substantial capital appreciation.

I will assume my readers are familiar with this life insurer and related terms and metrics, as I have published about LGEN many times - here is the latest.

Bird’s eye view

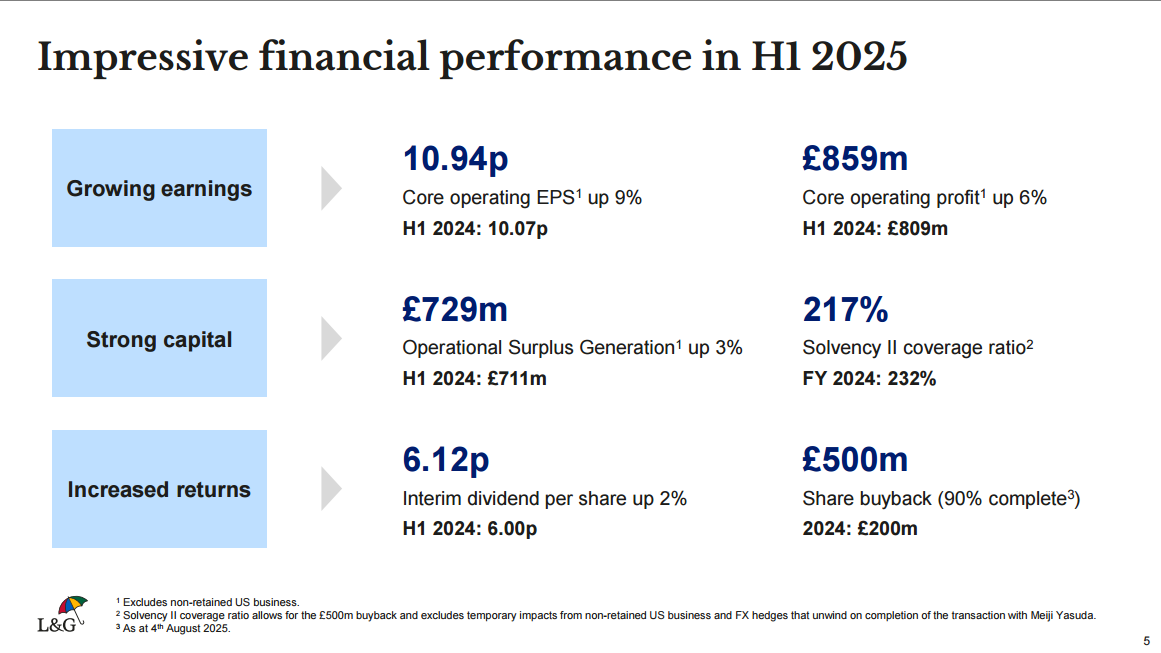

The results are summed up on the slide.

Thinking about this and subsequent slides, keep in mind that for practical purposes, and particularly for dividends, Solvency II (“SII”) statutory accounting is more important than IFRS.

Investors in LGEN have to be sure that if Mr. Anthony Simoes’s strategy does not succeed, they will at least keep receiving this wonderful dividend forever, even if it remains slow-growing. As a reminder: the current yield is 8.5%, the dividend growth rate is 2%, there is no withholding tax in the UK, and the dividend is qualified for the US reduced tax rate.

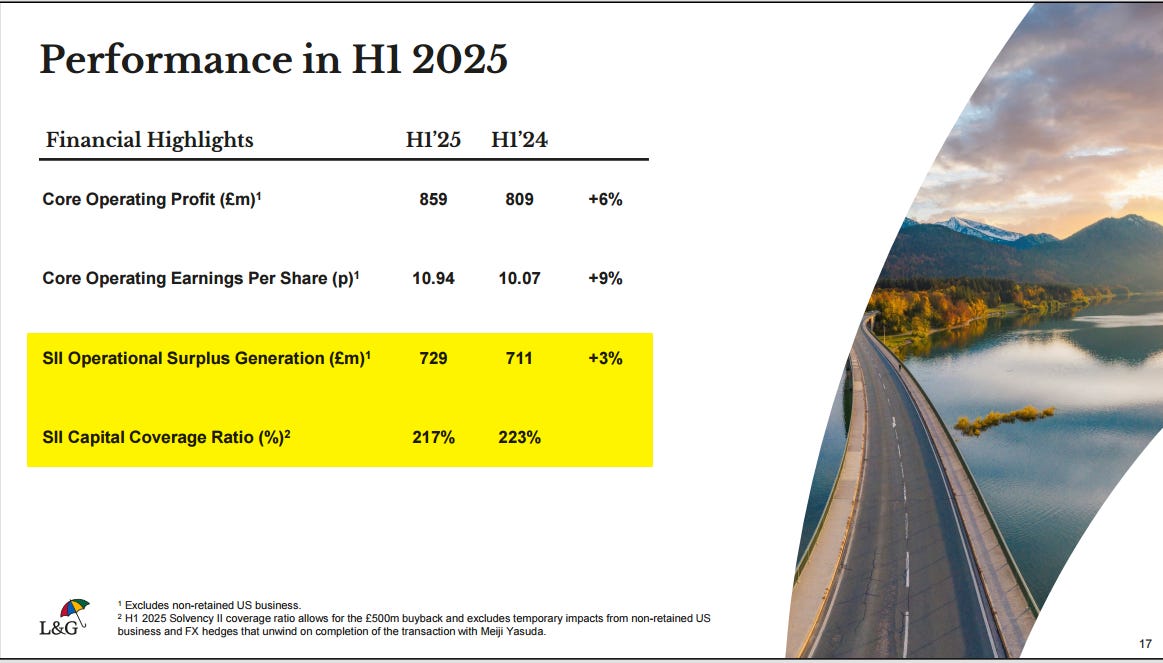

The ability to pay dividends is determined by two SII numbers that I highlighted in yellow on the slide below.

Note that while IFRS numbers in the two top rows were strong at the forecast’s high end, SII numbers were mixed.