This post is about Fairfax, but let me start with a question on Berkshire Hathaway: How do you explain its ~18% YTD return, despite a down market and a valuation that looks rich by traditional metrics like P/B?

We will circle back to this question and link it with our protagonist at the very end.

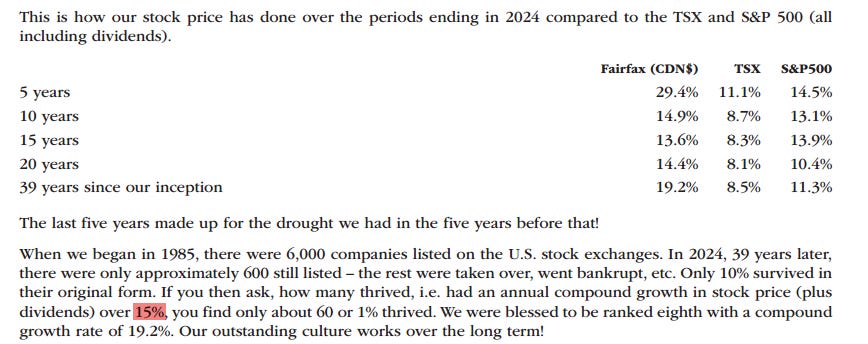

Fairfax’s 15% return target

In his latest letter (as well as in previous ones), CEO Prem Watsa mentioned a 15% target return for Fairfax (FFH in Canada, FRFHF in the US) shareholders multiple times. Let me quote several of them (everything is in MUSD unless noted otherwise):

To sum it up: Fairfax has delivered 15%+ annual returns since 1986 (the actual growth rate of BVPS is more than 18%). Its CEO aims and hopes to achieve a 15% return in the future. When we say “return”, we mean growth in book value per share, assuming that stock market returns will follow more or less in sync.

Needless to say, almost any investor would be happy to join the ride provided she is confident enough. But why does Prem Watsa mention 15%? Is it only because of Fairfax’s track record? I think there is more behind it.