Last time I posted about Western Midstream (WES) on May 13—Western Midstream’s 10% Yield is Tempting — The Real Story is What Comes Next. This is a direct sequel, and I will not repeat the full description of the complex WES situation that I covered in detail three months ago. The reason for this post is that now we know a bit more about what comes next.

Before we proceed, I would like to briefly remind you that WES likely has the highest yield of all investment-grade companies, at least in the US. It is even better that this yield is tax-deferred, meaning that no tax on distributions will be due for many years to come, since WES is an oil and gas master limited partnership (“MLP”) rather than a corporation. These distributions are growing and resilient, supported by multi-year fee-based cash flow and a conservative balance sheet. WES’s cash flows are largely insulated from commodity price volatility, thanks to their fee-based nature and minimum volume commitments.

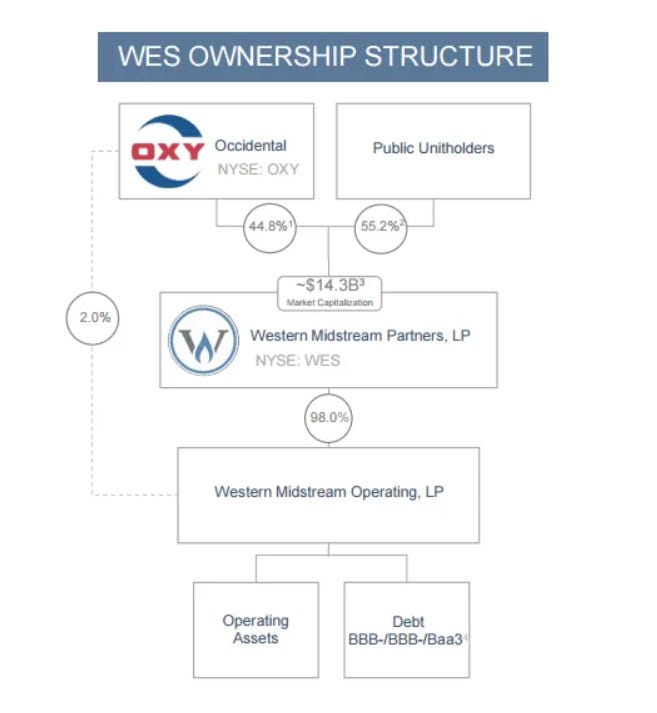

WES will not make you rich and is less attractive to young investors. To people in or close to retirement, it is highly attractive due to its yield. The biggest risk of investing in WES is its dependence on Occidental Petroleum (OXY), which controls the MLP through its GP units, owns 44.8% of its LP units, and is the main WES customer by far.

New developments

In this post, I will not spend time on WES’s Q2 operating results, as they were in line with expectations. The company reported some progress in adjusted EBITDA and gross margins on top of record-breaking throughputs in the Delaware basin. Since MLPs routinely invest growth capital, we generally expect the numbers to grow consistently, though not necessarily every quarter.

However, when reporting their Q2 results several days ago, both WES and OXY made several announcements that directly affect WES's risk profile.

First, WES agreed to acquire Aris Water Solutions (ARIS) for ~$1.5B in a stock and cash deal or ~$2B including Aris’s debt assumption. Aris is a water infrastructure company that handles, treats, and recycles produced water from oil and gas operations, primarily in the Permian Basin. Its business is largely fee-based, supported by long-term contracts with producers, making cash flows relatively stable and less sensitive to commodity prices.

Secondly, WES announced a new train at its existing North Loving gas plant in the Delaware basin. Finally, OXY announced a ~$1B sale of its non-core assets that further reduces its debt load. This $1B has appeared seemingly out of nowhere.

Individually, each of these events may seem minor, but taken together, they could signal a broader trend with meaningful implications for WES.

Before the announcements, WES was trading at about $40.33. Afterward, it fell to roughly $37.50, giving it a 9.7% forward yield based on current distributions, which are set to increase further in six months. Are the units likely to rise from these levels?