Western Midstream: The Unbearable Tightness Of OXY's Embrace

How to assess risks related to Oxy's control of Western Midstream.

I have just published an article about Western Midstream (WES) on Seeking Alpha. Here is the link though it might be behind a paywall. SA prohibits republishing its articles elsewhere and so I will publish here a shortened and modified version for my Substack readers.

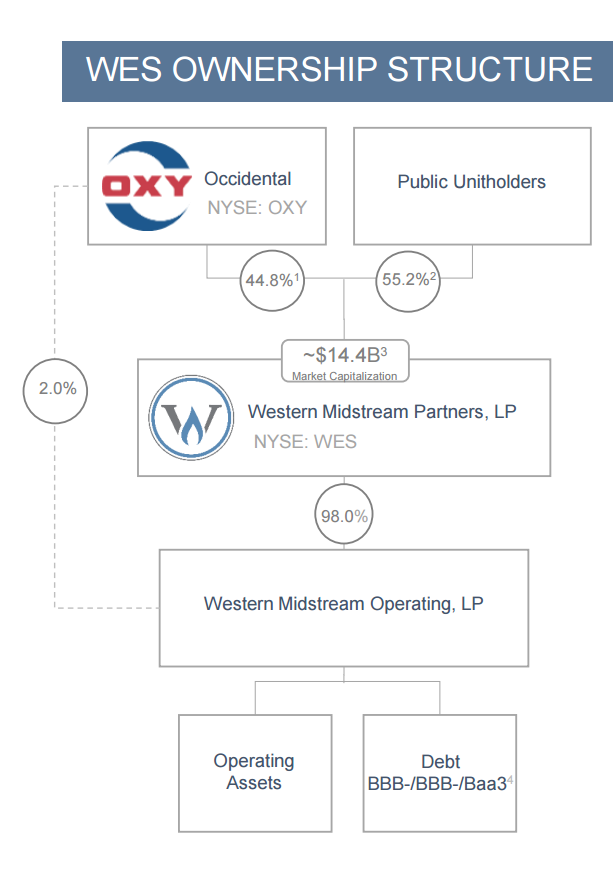

Occidental Petroleum’s (OXY) controls WES through the combinations of GP and LP units as in the picture below from WES’s filings:

Following its recent acquisition of CrownRock, OXY needs to deleverage. Selling its WES units—or potentially arranging the sale of WES in its entirety—remains a viable strategy to achieve this goal. However, it creates a possible conflict of interest.

If we remove OXY from the picture, WES is an alluring buy due to its 9.2% tax-deferred yield, growing distributions, investment-grade ratings, strong operational and financial KPIs, good positions in prolific basins, and limited sensitivity to commodity prices because of fee-based revenues.

On a macro level, demand for the US natural gas midstream infrastructure (WES is mostly in natural gas) is supported by reduced Russian exports, increasing energy needs from data centers, and the new US administration favorable to oil and gas.

OXY blurs this clear picture big way. First, it is not aligned with WES public LPs. Here is an extract from WES’s 10-K:

“Occidental owns our general partner. Occidental’s ownership of our general partner may result in conflicts of interest. The directors and officers of our general partner and its affiliates have duties to manage our general partner in a manner that is beneficial to Occidental. At the same time, our general partner has duties to manage us in a manner that is beneficial to our unitholders. Therefore, our general partner’s duties to us may conflict with the duties of its officers and directors to Occidental. As a result of these conflicts of interest, our general partner may favor the interests of Occidental or its owners or affiliates over the interests of our unitholders.”

Secondly, OXY recently replaced CEO Michael Ure (a multi-year leader widely respected by public LPs) with Oscar Brown without giving convincing reasons. Let me quote from WES’s filings again:

"Today Western Midstream Partners, LP (WES) (“WES” or the “Partnership”) announced Oscar K. Brown, an independent director of Western Midstream Holdings, LLC, WES’s general partner (the “General Partner”), has been appointed President and Chief Executive Officer of the General Partner, effective immediately. The Board of Directors of the General Partner (the “Board”) and Michael Ure agreed that he will step down from his position, including as Director. To ensure a smooth transition, Mr. Ure will continue as an advisor to the CEO until the end of the year. Mr. Brown will remain a director on the Board."

And further in the same release about Michael Ure: "We wish him the best as he shifts his focus to his greatest passions: his faith, his family, and giving back to the community".

The last paragraph, which discusses the individual with a career in operating pipelines and natural gas plants, seems to me as bordering on sarcasm.

The replacement of the successful Michael Ure with Oscar Brown may not be in the unitholders’ best interests. Mr. Brown is a former banker with a background in oil and gas M&As. As an SVP of OXY, he helped Vicky Hollub (OXY’s CEO) to take over Anadarko several years ago (future WES was a part of Anadarko). They both were on a plane to visit Warren Buffett in Omaha seeking financing for that takeover.

If OXY is considering the sale of WES, it would provide a clear rationale for Mr. Brown’s appointment. The sale of WES could involve several complex scenarios, making his expertise particularly valuable in navigating such a process.

OXY could either sell only units they hold or attempt to arrange the sale of WES in its entirety. The second option would be preferable for OXY as the price per unit should be higher. There are three types of possible acquirers: Berkshire Hathaway, other midstream companies, and private equity. Early in 2024, Reuters reported that OXY was exploring a sale of WES naming Enterprise Products (EPD), The Williams Companies (WMB), Kinder Morgan (KMI), and private equity as potential acquirers. Berkshire was not named but knowing its closeness to OXY, I would not exclude it.

On August 12, OXY announced a partial sale of its WES units (about 10% of its holding) at ~$36 per unit. I initially interpreted it as a confirmation of OXY’s intention to retain the balance. But what if OXY intended to divest its entire stake but couldn’t reach a timely agreement on price or other terms? It could trigger OXY to initiate a partial sale to show quick progress in deleveraging while continuing negotiations regarding the entire stake. Please consider the following quote from Ms. Hollub on the last earnings call while discussing deleveraging:

"We think we've already had some significant success over the $4 billion, but we do believe that even in a lower price environment, we're going to have some cash flow. We're still going to have some divestitures. We'll still make progress in 2025 regardless of where prices will be. And that's our target. Our target is to continue our debt reduction through the year, regardless of what it takes to do that."

Let us consider possible scenarios and their ramifications for LPs:

OXY does not sell WES or sells only a partial stake again. Most likely, LPs will keep receiving their tax-advantaged and rich distributions and also enjoy some capital appreciation.

OXY is successful in arranging the sale of WES in its entirety. LPs will keep receiving distributions for a limited time and will get short-term capital appreciation. Since the partial sale was executed at $36, I would expect a full sale in the low to mid-forties. The long-term holders may lose here because of significant taxes due on depreciation recapture.

OXY sells only all of its units. I would expect them priced above $36 but lower than in the second scenario. Based on the acquirer, the deal may or may not become painful for LPs. Private equity may attempt the so-called “takeunder” squeezing LPs by, say, slashing distributions and later offering them a rather low price. This scenario is not the likeliest and can be challenged in court later but it represents a real risk nonetheless.

I am holding WES and even added at $36 but would like my readers to fully understand the risks involved without being blindly baited by the high yield.

I want to thank all of my Substack subscribers again. The fate of this little venture depends on your subscriptions.