This is my third article about Canadian Alimentation Couche-Tard (“ACT”). “Alimentation Couche-Tard: 18% Compounding And 26% Dividend Growth, Cheaper Than The Index” and “Alimentation Couche-Tard's Takeover Attempt Of Seven & i Is Not Hopeless” were published on Seeking Alpha. The content below is mostly new but some overlap is unavoidable.

Company’s Description

ACT trades in Toronto as ATD and in the US as ANCTF. ATD is more liquid and the Toronto Stock Exchange is the preferable trading venue. For US taxpayers, dividends are taxed at 15% Canadian withholding tax or 0% in IRA and similar accounts.

ACT operates convenience stores ("CS") with road fuel stations primarily in the US, Canada, and Nothern Europe. Worldwide, the network comprises ~16,800 stores including company stores (10.5K), company-operated dealer-owned stores (1.4K), dealer-owned dealer-operated stores (1.5K), and 2,300 licensed stores in 16 countries outside the main markets. Its best-known and by far the biggest brand is Circle K.

Two lines - Fuel and Merchandise & Services - form most of its revenues. Merchandise consists of products inside stores such as tobacco, all kinds of drinks (beverages, gourmet coffee, beer, and wine), food including freshly made, and miscellaneous items. Services include car washing, ATM fees, licensing fees, lottery ticket and phone card commissions, and, importantly, electric charging. While Fuel dominates revenues, gross margins are almost evenly split between Fuel and Merchandise & Services.

While CSs are simple in concept, ACT is a complex and sophisticated business that sells indispensable products that everybody needs. It is an outstanding company. On December 1, 1996, it started trading at split-adjusted CAD 0.18. It trades at ~CAD 74, representing a CAGR of ~24% over ~28 years, not counting dividends!

This growth is not attributable solely to the early stages when the company was small. Over the last 10 fiscal years from 2014 to 2024 (ACT's FY ends on the last Sunday of April), the stock's CAGR is 18% in CAD or ~16% in USD. Dividends add about 1% to these numbers.

ACT is shareholder-friendly to the extreme. It has grown dividends at ~26% per year and ~10 times over the last 10 years! Aggressive buybacks are regular. It has only one class of common shares with ~19% of insider holdings. Its co-founder and long-time CEO Alain Bouchard is now the Executive Chairman and holds ~13%. ACT's financial reports are clear and transparent.

Despite all this, ACT trades at a trailing P/E ratio of only ~19 and is cheaper than the S&P 500.

The CS Industry

ACT’s main markets are the US, Canada, and Nothern Europe. We will focus on the US as it is responsible for roughly 2/3 of the company’s revenues and margins. Conveniently, ACT reports in USD despite trading in CAD.

The US CS industry has two distinctive features - it is fragmented and it is growing as displayed on the company’s slides below.

Big chains operate only 22% of US CS stores. With ~7,000 stores (less than 5% of the total 152,396 stores in 2024), ACT is the second biggest after Japanese Seven & i better known as Seven-Eleven (“7-11”) for its major business. The number of US CS stores is growing while certain other categories of retailers (such as grocery and drug stores) are shrinking.

There are several reasons for the industry's success - busier lifestyles, urbanization, smaller households, expanded product offerings, and fuel integration (80% of US CS stores sell fuel). The latter reason insulates CSs from online competition.

ACT is the most efficient operator in the growing industry. It enjoys scale and location advantages and has plenty of opportunities to increase its footprint organically and through acquisitions. On the last earnings call, management emphasized that under today’s challenging economy (more on it later), ACT keeps taking share.

Besides 7-11, other US competitors are limited to North America and may lack some of ACT’s corporate knowledge. For example, since 2019, ACT has successfully operated charging stations in Norway, a country where plug-in hybrids and EVs account for one-third of cars in use. Correspondingly, ACT is better positioned versus other CS operators for a gradual increase of EVs in the US.

ACT and Seven & i

ACT is trying to acquire its bigger Japanese rival 7-11 and recently, upped its offer to $47B. We know this number from Bloomberg/Reuters—there have been no official confirmations from either ACT or 7-11. 7-11 stock (3382 in Tokyo, SVNDY and SVNDF in the US) has been stagnant for years despite investing a lot in acquisitions in the US. It beats ACT easily in the number of stores but has a lower market cap. The last offer from ACT values 7-11 at about 9.4 EV/EBITDA multiple (this is not counting the last dismal quarter reported several days ago).

In defense against ACT, on its last earnings call, 7-11 announced steps to streamline its business. Japanese management is reluctant to negotiate but is under pressure from some of its shareholders. The management may or may not succumb to this pressure. Even if the companies agree on the deal, it may or may not get approval from Japanese regulators. Until recently, this approval was almost unthinkable but today’s investment climate in Japan is more favorable to foreign acquisitions.

If both conditions are met, the companies must clear US regulators which seems probable albeit with concessions. The combined company will be the biggest CS operator in the US by far but with a market share of only 15%. On top of it, the industry has plenty of external competition for both food and fuel such as supermarkets, dollar stores, Wal-Mart, Costco, etc.

For probabilities that are difficult to estimate, it makes sense to assign a 50% probability to each of the two possible outcomes. Consequently, the deal has a 25% probability of going through, assuming a 50% likelihood of approval from both Japanese management and regulators, with the assumption that U.S. clearance is certain.

Closing the deal should be a significant positive for ACT, even with the uncertainties surrounding transformational acquisitions. ACT is an acquisition machine with an unblemished track record. They know the CS industry better than anybody and are skilled in achieving synergies. ACT's leverage (net debt/EBITDA) is expected to surge, reaching approximately 6.2, according to my calculations (excluding 7-11’s last quarter). Typically, ACT deleverages quickly though their leverage has never been that high. Still, while performing due diligence, ACT’s management team will estimate the synergies and, provided they go ahead, we can only trust their judgment.

If announced, the deal may bring the ACT stock down due to high leverage and uncertainties of integration. It would appear a unique opportunity to load up.

Valuation

ACT stock has retreated since early 2024 from the mid-eighties to the low seventies due to 1)mediocre results for the last several quarters and 2)uncertainties related to the possible mega-acquisition.

The company blames its recent performance on weak economic conditions in key markets. While ACT is not strictly cyclical, 2024 posed challenges for low-income consumers. A CS with a fuel pump is a democratic destination where both the wealthy and the poor spend similar amounts. This makes the company exposed to a broader base of lower-income consumers suffering from inflation and high interest rates. This was evident in smaller customers’ baskets.

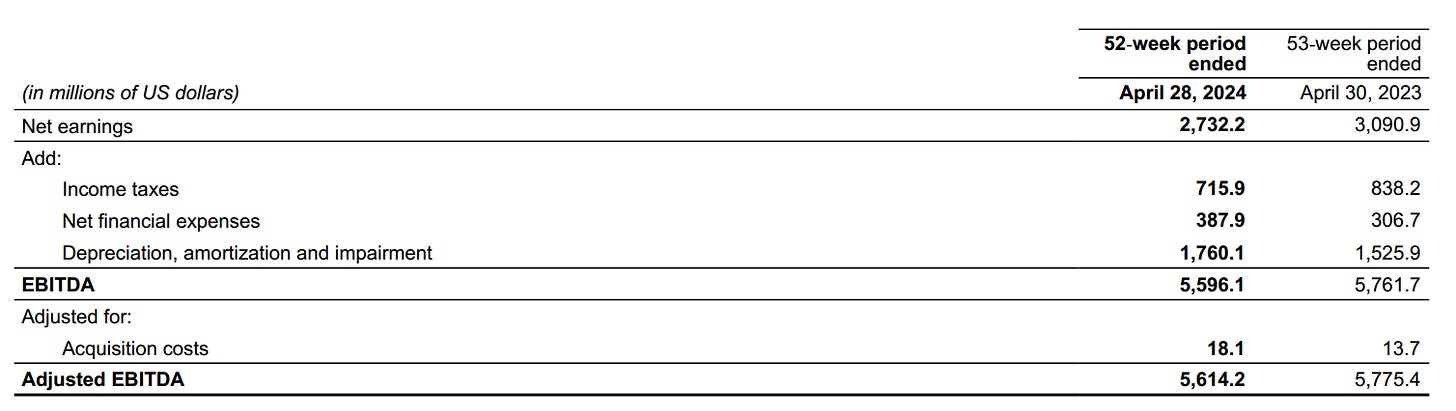

ACT emphasizes non-IFRS EBITDA as a measure of cash flows is natural for the acquisitive industry.

ACT reports three “species” of EBITDA:

EBITDA as derived directly from net earnings.

Adjusted EBITDA that introduces corrections for certain non-recurring items. For ACT, the difference between the two is negligible.

Pro forma EBITDA is equal to adj. EBITDA plus the pre-acquisition estimate of EBITDA generated by acquired operations from the start of the fiscal period. Pro forma EBITDA differs from adj. EBITDA only in years when big acquisitions occur.

Around Jan 1, 2024, ACT closed two transactions with Total Energies for ~$3.8B to acquire over 2,000 CSs in four European markets. Accordingly, pro forma EBITDA seems a better gauge of cash-generating ability on a TTM basis. Below are reconciliations for three types of EBITDA from FY 2024 filings:

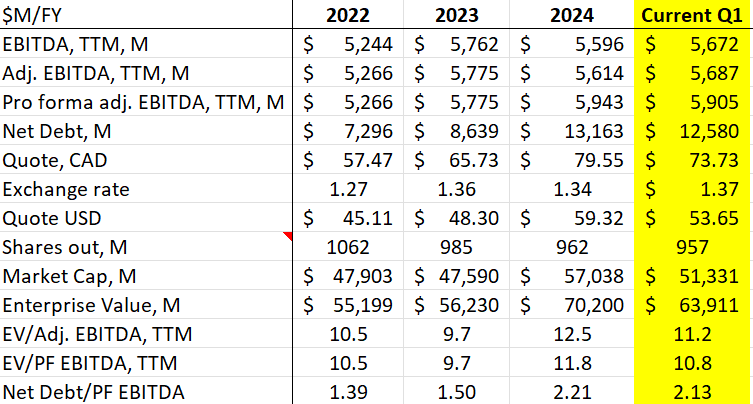

In the table below, I present my calculations of EBITDA multiples for several TTM periods. The most recent results are highlighted in yellow.

The current EV/PF EBITDA of 10.8 is within the company’s normal range. However, we know that ACT is at a cyclical low now. With subsiding inflation and lower interest rates, low-income consumers are expected to recover and improve ACT’s cash flow. From this standpoint, ACT may be slightly undervalued.

For the first time in the company's history, EBITDA in 2024 was lower than in the previous year. Besides the shorter fiscal year of 2024 (52 weeks vs. 53 weeks), this is the result of the consumer’s weakness, as we discussed above.

Despite lower EBITDA, today’s ACT is arguably a better cash-generating machine than in 2023. Even excluding acquisitions, this is true for several reasons.

Firstly, and most obviously, ACT continues expanding its store footprint organically, adding around 100 new locations annually. Secondly, ACT is in the middle of rolling out its “Inner Circle” loyalty application in the US. Not all stores are covered yet by the loyalty program, but the participating ones deliver better numbers. Once the app matures, it will open new opportunities for ACT. Thirdly, ACT is implementing several programs to become more efficient across its network. Instead of going into details, I will present ACT’s strategic plan until FY 2028 which incorporates everything above and more.

The plan is aggressive. Let us estimate the returns it is supposed to generate for shareholders. At a typical 11 multiple, EV will become 11*10002 ~ $110B. At ACT’s preferred leverage of 2.25, its net debt will be 2.25*10,002 ~ $22.5B. It corresponds to the market cap at the end of April 2028 of 110-22.5=$87.5B or 1.37*87.5 ~ CAD 120B at today’s exchange rate. The latter figure implies a CAGR of ~16% not counting dividends and buybacks which should add 2% more for an IRR of ~18%.

I wouldn't dismiss this public plan lightly, given ACT’s track record. The resulting IRR would be in line with the company’s recent historic returns.

Beyond valuation

Purchasing ACT stock is not what a pure value investor would do. It is for those who are keen to buy “a good company at a fair price” using Warren Buffett's words or to buy growth at a reasonable price.

For the money spent, an investor gets the best management team and the most efficient shareholder-friendly operator in the growing and fragmented industry. This is not even counting vast geographies where ACT is not present yet or present at a minimum - Latin America, Australasia, and big parts of Europe. And this is in addition to strong free cash flow.

ACT defines its free cash flow unusually - excluding dividends!

This definition emphasizes the sacrosanctity of dividends on the one hand but also shows how much cash will be opportunistically invested in inorganic growth (part of it though will be spent on buybacks).

Smaller acquisitions happen all the time and are managed by a local business unit. Every 2-3 years, the company closes a strategic acquisition like the recent one with Total Energies. All targets are carefully selected and typically acquired at EV/EBITDA below 10. Since ACT itself normally trades at a higher multiple, acquisitions become accretive from day one. Within several years, cost synergies and operational changes drive EBITDA up 30-60%. In acquisitions, ACT is as efficient and experienced as in operating its stores.

The overall efficiency is confirmed by the ROE above 20%. Even in a relatively weak FY 2024, it was 21.2%. Typically, it is in the mid-twenties.

A combination of non-tangible management skills, a favorable industry, a big addressable market, and strong cash flows at a reasonable price makes ACT attractive if not a bargain.

At a P/E ratio of ~19, manageable debt with an investment-grade rating, scale advantage against most competitors, and considerable experience in EV charging, risks do not appear excessive.

The potential acquisition of 7-Eleven represents a significant upside. The expanded scale and access to the Asian market would give ACT an even greater opportunity to leverage its highly developed expertise.