I invested in Progressive Corporation (PGR) in 2021, after finally grasping, thanks in part to Warren Buffett’s repeated praise, that it’s one of the most exceptional companies and stocks in the world. I wish I had figured it out earlier, but better late than never. “Better late than never” may still apply to those who have not invested yet.

Judge yourself:

Over the last 40 years, PGR has compounded at almost 19%.

Over the last decade, it hasn’t had a single down year, delivering 20–40% in most years, with a couple of calmer years around 10%.

My annual IRR over the previous 4.2 years is ~27%.

YTD, PGR has delivered 9% inclusive of its recent slide, and its BVPS was up ~13% in Q1 alone.

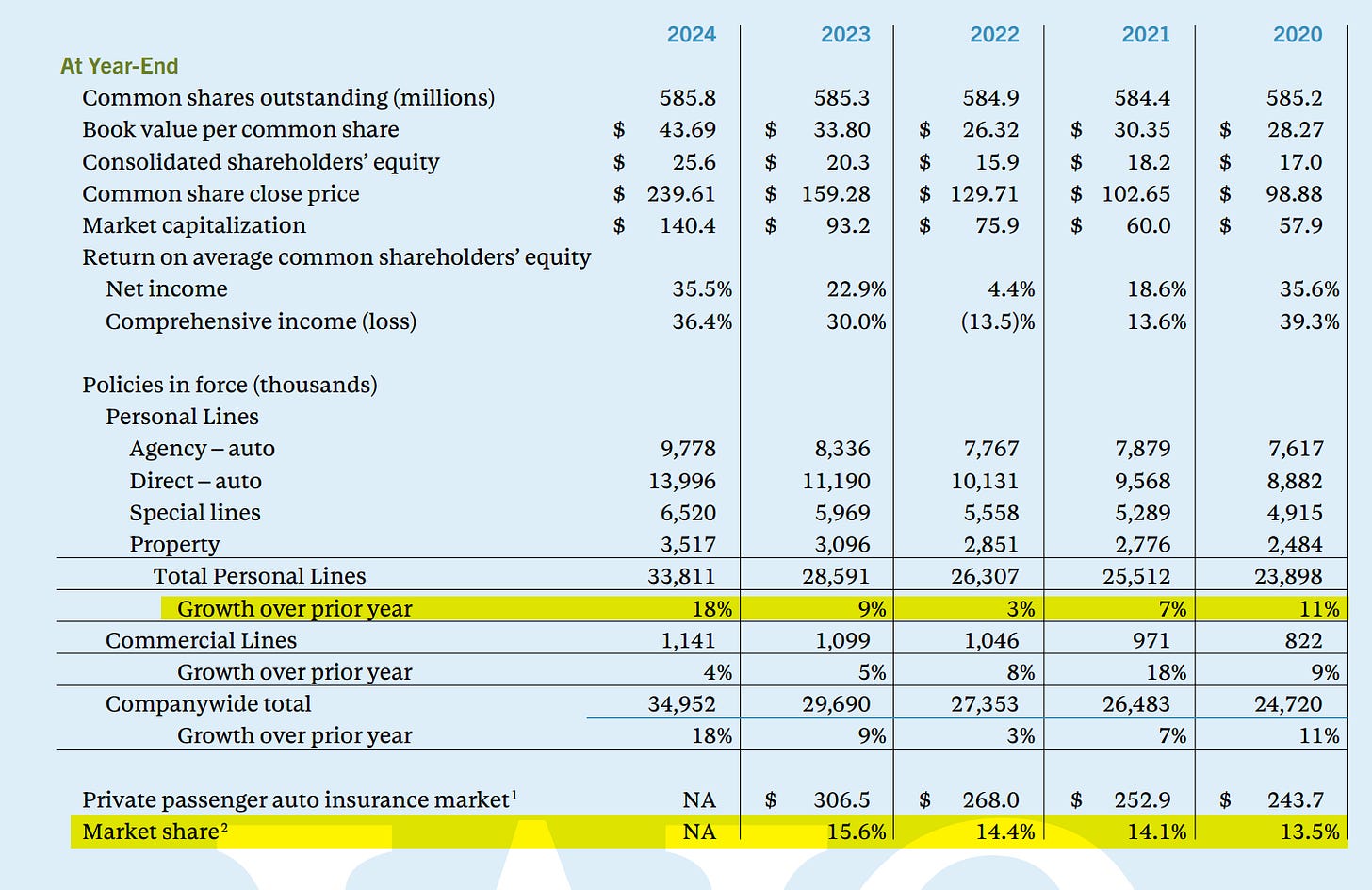

Check Progressive’s results over the last five years. I highlighted the two most important lines.

Progressive has achieved all this in the deeply commoditized auto insurance market, winning against formidable competition led by Berkshire Hathaway’s crown jewel, Geico. You can learn about it in my free “Buffett’s Letter, Geico, and the Ongoing Rivalry with Progressive.”

Many still underestimate this “unsexy” auto insurer. I am certain about it—my articles on Progressive consistently get fewer views than almost anything else I write!

A quarter ago, PGR was trading at $291, while it is at ~$245 now. Is this low enough to open or add to a position in PGR?

Morgan Stanley downgrades

On July 7, Morgan Stanley downgraded Progressive from an “Overweight” to an “Equal Weight” rating. I do not have access to their original note and will quote from SeekingAlpha:

"Our previous Overweight thesis on unincumbered growth and margin expansion is nearing its end, in our view. As the market evolves, we see two factors that change the investment thesis for Progressive: 1) intensifying industry competition and 2) potential pressure on Progressive's valuation due to exiting a peak growth and margin environment," said analyst Bob Huang in a research note.

The analyst noted that the industry faces increased competition and reduced benefits from inflation recovery, and as Progressive grew unobstructed by competition in 2024, the future growth is expected to slow.

"These industry-wide changes and idiosyncratic thesis shift lead us to downgrade Progressive to Equal-weight. On a relative basis, we see Allstate as having an easier hurdle to overcome, a more attractive valuation, and potentially not over earning," added the note.

The price target was reduced to $290 from $330.

If the competition intensifies, it should show up in either slower growth or compressed margins, i.e., a higher combined ratio (“CR”) equal to 100% minus the underwriting margin.

I will present two slides showing both metrics over time, which we will use throughout this post.