Even After the Drop, Blackstone Still Isn’t a Bargain

Investors should think twice before interpreting the dip as a buying opportunity

Alternative asset managers will remain the focus of this blog. This compels us to revisit Blackstone (BX) from time to time, as it is by far the largest and most influential company in the segment. (If you are not familiar with alt managers, please read my Primer on the author’s page.)

Last time, we did it in early December, and for new readers, I will have to repeat our main conclusions. But first, I want to make it clear that I'm a big fan of Blackstone and will happily jump on board with both feet as soon as I deem the risk-reward ratio skewed in investors’ favor. Last time it occurred in 2022 due to the limited liquidity of Blackstone’s non-public REIT. I wish I had bought more back then…

Last December, when I wrote my post, BX was trading at around $187, and I forecasted a 30–40% decline and sold my position accordingly (I kept a minuscule holding to better track the stock). Today, the stock sits at $127—a drop of ~32%. Of course, this level of precision is purely accidental. All forecasts are probabilistic and may or may not materialize. That said, we significantly improve our odds when we base our views on the well-chosen valuation metric.

Blackstone short review

This section closely follows my last post for the benefit of new readers.

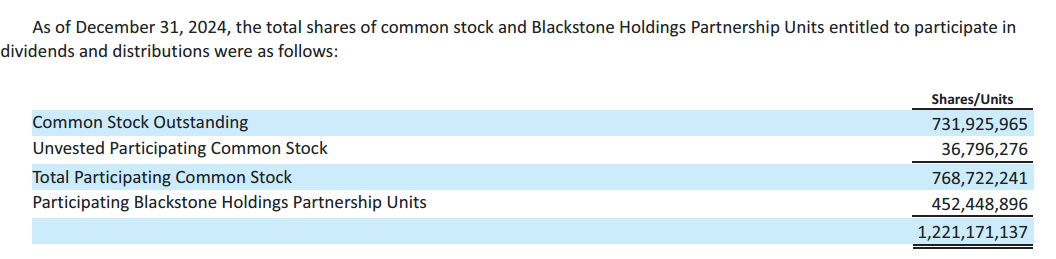

Blackstone operations are owned by both Blackstone, Inc. (the one trading on NYSE as BX) and the Blackstone Holding Partnership, with units exchangeable on a one-to-one basis to BX shares (both groups are equally eligible for dividends/distributions). The unitholders consist of management, employees, and some third parties. Every year (since 2019 when Blackstone was converted into a corporation from a partnership), some units are being converted into shares, but new units are being issued to certain newly hired and pre-existing senior managing directors. This process is not very transparent, but currently, about 63% of owners consist of shareholders and 37% of unitholders. In 2023, shareholders represented 59% of owners. For better understanding, here is an excerpt from the 10-K:

This picture is further complicated by the different tax statuses of both groups and the preferential status of unitholders. Here is another quote from the 10-K:

The Founder, senior managing directors, employees and certain other related parties invest on a discretionary basis in the consolidated Blackstone Funds both directly and through consolidated entities. These investments generally are subject to preferential management fee and performance allocation or incentive fee arrangements. As of December 31, 2024 and 2023, such investments aggregated to $2.0 billion and $1.7 billion, respectively. Their share of the Net Income Attributable to Redeemable Non-Controlling and Non-Controlling Interests in Consolidated Entities aggregated $176.0 million, $87.8 million, and $10.9 million for the years ended December 31, 2024, 2023 and 2022, respectively

Whatever we might think about the preferential status, it barely affects the results as insiders’ investments represent a negligible fraction of ~$1T+ of Blackstone’s AUM.

With some exceptions, GAAP accounting is not helpful because BX has to consolidate data attributable to non-controlling interests (NCI). Different from some other alt managers, NCI includes not only investees (i.e., companies owned by Blackstone funds sourced primarily from third parties) but also the owners of Blackstone Holding Partnership Units. Because of these complications, almost everybody uses BX non-GAAP data.

Still, there is one useful conclusion from the Balance Sheet: BX stockholders’ equity was $8.2B on Dec 31, 2024, vs. about $155B of its market cap. Consequently, we will ignore equity for valuation purposes.

Blackstone is different from other asset-light alt managers (such as ARES, OWL, BAM, or the asset management segment of APO) as it is not management fee-centric. It has two other significant sources of income: carry (i.e., income generated from successful investment exits) and performance income (i.e., fees generated once Blackstone’s investment results reach certain thresholds without exiting). Two other sources of revenues - transaction fees and realized principal investment income (i.e., returns on Blackstone’s invested capital) are relatively small, though not negligible.

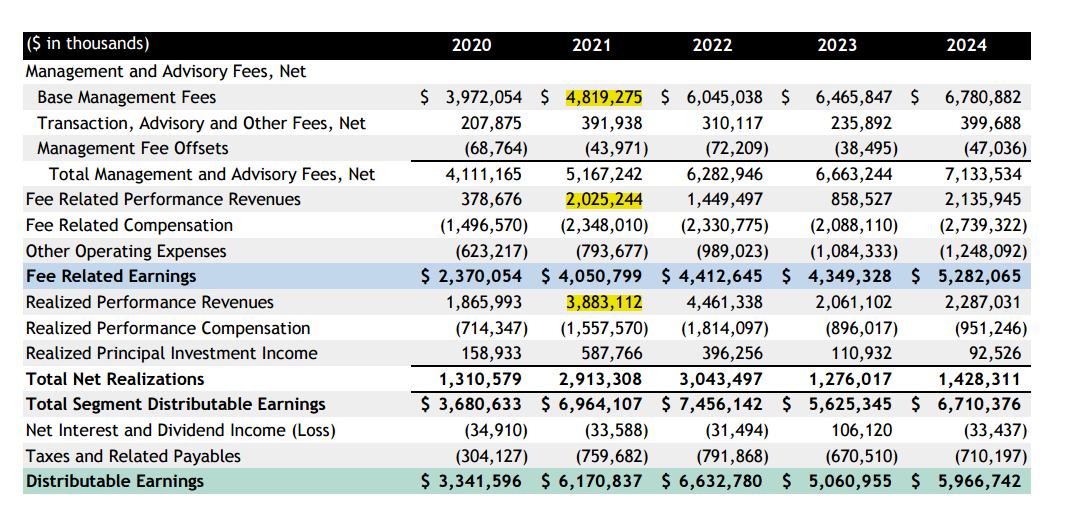

Since performance income and carry are cyclical and can fluctuate wildly from year to year, it makes Blackstone unfit for traditional valuation metrics such as P/DE (Distributable Earnings), P/FRE (fee-related earnings), or dividend yield (Blackstone pays out the lion’s share of its DE in dividends). To make this visible, I will present a slide from the BX Q4 24 Supplementary with 5-year non-GAAP income data. In 2021, both performance income and carry were comparable with management fees (3 main sources of revenue are highlighted in yellow).

The same phenomenon, to a slightly lower degree, also occurred in 2022. As a result, DEs for 2021 and 2022 were higher than for 2023 or 2024. Does it mean that Blackstone in 2024 was less valuable than in 2021 or 2022? Not at all, and still many analysts pay close attention to a P/DE ratio to value the company.

One final caveat: Blackstone’s FRE includes a significant portion of fee-related performance revenues, making it difficult to compare directly with the management-fee-centric FRE reported by other alt managers.