Buying Fairfax Now: Smart Move or Late to the Party?

Investors are quite happy with Fairfax Financial's (FFH in Canada, FRFHF in the US) run. Here are its recent returns in USD:

2022 - 23%

2023 - 58%

2024 - 53%

2025 YTD - 27%

Keep in mind, these returns didn’t come from a high-flying growth stock, but from a relatively safe investment and insurance vehicle, modeled on the Berkshire Hathaway blueprint.

Granted, Fairfax’s path was not entirely smooth in the past. However, several years ago, the company zeroed in on its insurance operations and made underwriting discipline a top priority. Fortunately, this strategic shift coincided with the onset of a hard market in insurance. A depressed stock price and aggressive share buybacks reinforced that winning combination. Together, these four factors largely explain the company’s strong recent returns.

In today’s post, we’ll examine whether Fairfax still has room to run—and what investors can reasonably count on going forward.

We have already reviewed Fairfax several times, and I will assume my readers are familiar with the company. My bullish Fairfax Again? Yes—And Here’s Why was the latest almost four months ago, when the stock was at $1486 (I will use only USD in the post. Canadian Fairfax reports in USD.) The shares have climbed another ~18% since, and the company has just reported Q2 with some interesting developments—it is time for an update.

To answer the question in the title, we have to start by valuing Fairfax shares.

SOTP valuation - how good is it?

Most often, investors value both Berkshire and Fairfax using SOTP (sum of the parts). It seems very natural to split operations between insurance and investments and value them separately. For reasons which will become clear shortly, Berkshire is better suited for this approach.

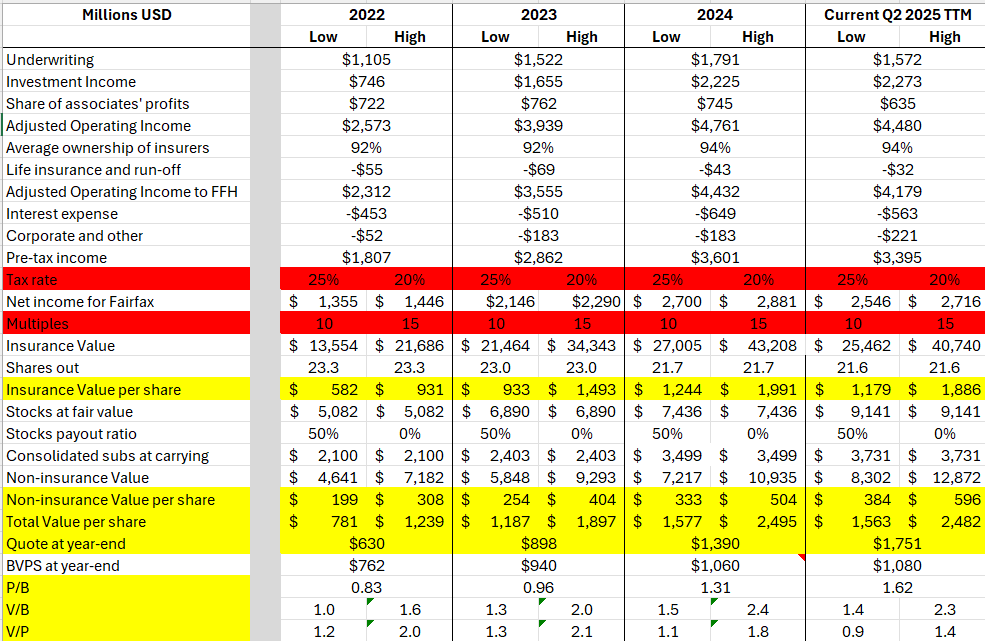

Here is my version of Fairfax SOTP valuation, but other variations are possible too.

Some explanations are needed to digest the table:

I evaluated insurance operations based on their adjusted Operating Income to FFH, consisting of underwriting profits, investment income, and share of Associates’ profits. These results are prorated by Fairfax’s average ownership of insurers. Interest expense and corporate overhead are deducted. The result is adjusted for 20-25% tax and valued using 10-15x multiples typical for insurance operations.

Fairfax is holding equities as Associates, mark-to-market stocks within insurance portfolios, and Consolidated Subsidiaries. We have already fully accounted for Associates, as their proportional profits were included in the Operating Income.

Mark-to-market common stocks have been accounted for in Operating Income through their dividends. If a stock's payout ratio is 0%, we have not accounted for it at all. If it is 50% (this is the highest I can imagine), we have accounted for only half of it. Consequently, we valued this group within the range of 50-100% of its Mark-to-Market value and have to add the balance.

For the Consolidated Subsidiaries, we used their carrying value (as opposed to their bigger mark-to-market value - more about it later). Since their dividends are negligible, if any, we have not accounted for them at all through Operating Income.

The bottom line of the table shows the calculated Value-to-Price ratio. As long as it is higher than 1, FFH should be attractive.

The ratio was high in 2022–23 and remained elevated in 2024. Today, it still appears on the value side, but its lower bound—based on a 10x multiple for insurance, 50% of mark-to-market stocks, and a 25% tax rate—stands at 0.9, suggesting the current price may be approaching the stock’s intrinsic value.

Having presented all of the above, I am skeptical about using SOTP for Fairfax. Here is a simple question: is Fairfax’s insurance business more valuable today than at the end of 2024?

Based on the SOTP, the answer is no. From my table, Fairfax’s insurance operations at the end of 2024 were worth $27-43B vs. $25-41B today. It is so because of the terrible catastrophic event in Q1 25—the Californian wildfires. But this was a random event. If it had not happened, the SOTP valuation of insurance operations today would be higher compared to 2024, as both premium written and the combined ratio, excluding cat events, were stronger in 2025!

If we are to accept SOTP valuations, we have to accept that Fairfax’s (or any other insurer’s!) intrinsic value is dependent not on its long-term average underwriting results but on the timing of specific cat events. I am uncomfortable with this statement.

One might argue for using average underwriting results instead of the TTM, which would smooth out short-term volatility at the expense of simplicity. But the next question now concerns interest rates. Fairfax currently earns a 5.1% yield on its fixed income portfolio—a level unlikely to persist if interest rates decline. This is particularly relevant given Fairfax’s sizable allocation to short-term instruments, which are highly sensitive to policy shifts. A drop in rates—amid the ongoing tug-of-war between the Fed and the President—would reduce investment income and, by extension, Fairfax’s valuation. Of course, the reverse would also be true. Yet over time, Fairfax’s intrinsic value—like that of any insurer—should be anchored to some normalized, long-term average interest rate.

It might be possible to adjust for it as well. But how about the multiples I used? They are typical but still rather arbitrary and may require adjustments as well.

The problems with SOTP arise from the difficulties of valuing insurance operations using arbitrary multiples and TTM results. For Fairfax, insurance operations dwarf investments (from our table, insurance represents 75% of Fairfax's value). For Berkshire, it is probably the other way around, and consequently, Berkshire is better suited for SOTP.

While SOTP might be flawed for valuing Fairfax, it is not useless. The method is straightforward, simple, and works for many practitioners. Still, can we come up with something better?