A week ago, I suggested that Apollo Global (APO) holders check out “Athene Insurance Deep Dive” by Rod Dubitsky, and have received several responses requesting my point of view. Although the article was published on January 9, 2025, I only came across it recently by accident, and none of my readers mentioned it — a sign that it likely failed to resonate with a broad audience.

The article raises concerns about the safety of Athene’s investment portfolio, given its significant exposure to private credit and related risks. In my view, that concern applies broadly across the industry, not just to Athene.

Asset-heavy alternative managers such as KKR (KKR) and Brookfield (BN) run insurance subsidiaries similar to Athene, though arguably of lower quality.

Asset-light managers like Blackstone (BX), Blue Owl (OWL), Brookfield (BAM), and Ares (ARES) originate and distribute private credit (including below-investment-grade debt) and manage portfolios across insurers, BDCs, institutional mandates, and wealth funds. They don’t hold direct credit risk on their balance sheets, but their earnings hinge heavily on private credit performance, and their stocks fully depend on their earnings.

Traditional life insurers also rely increasingly on private credit in their general accounts, and their portfolios are often managed by the same asset-light alt managers.

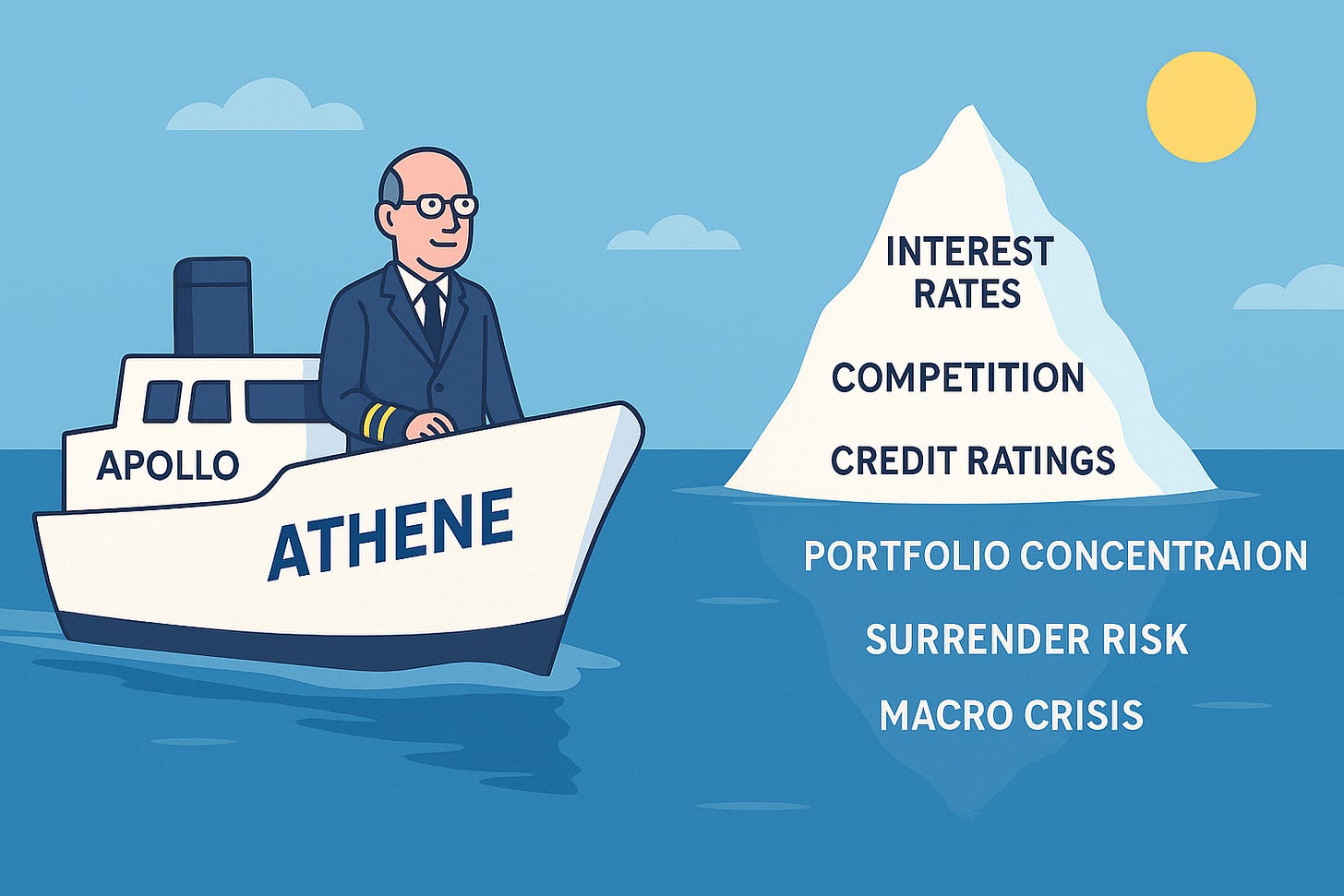

In short, the potential vulnerabilities highlighted in Athene’s case are systemic: they reflect the growing dominance of private credit across both alternative asset managers and life insurers. Investors need to keep this broader perspective, but in our analysis, we will limit ourselves strictly to issues about Athene raised by Mr. Dubitsky.

Mr. Dubitsky is a well-known economist with over 30 years of experience in financial services and global development. He is a seasoned credit and structured finance expert, formerly leading asset-backed securities research for Credit Suisse and also working for PIMCO. In preparations for his article, Mr. Dubitsky “parsed through a 3000-page Q2 2024 Athene statutory filing” in addition to using Athene SEC filings such as 10-Q and 10-Ks. I have neither read any other analysis as deep nor have I undertaken a review of Athene’s statutory filings myself.

His paper struck me on first reading — skillfully crafted, but focused almost entirely on Athene’s negatives while ignoring the positives. On a second reading, however, cracks in his arguments began to show. They become apparent when each point is considered on its own, rather than absorbed all at once in the sweeping critique.

I can’t escape the impression that Mr. Dubitsky approached Athene with a negative bias from the start. The piece feels written to reinforce an already-formed view rather than to weigh both positives and negatives and draw a balanced conclusion — the way one would expect in a more objective analysis.

To illustrate this bias with an example, I will quote a sentence from the very beginning.

In my prior posts I raised concern over Athene's very large leading market share in annuities as well as potential similarities to Executive Life insurance - an insurance company that failed owing to excess exposure to junk bonds and coincidentally Executive Life was Apollo's first big deal.

From this, a reader not familiar with the Executive Life bankruptcy, which happened 35 years ago, may think that Apollo caused or at least was somehow related to the bankruptcy. Nothing could be further from the truth. Apollo got involved with Executive AFTER its bankruptcy, and the whole operation was Apollo’s first big success. The author could have easily chosen his wording differently to avoid this impression, but he did not.

This is a minor point that may affect the reader’s perception, but does nothing to diminish the depth of Mr. Dubitsky’s analysis, which I encourage everyone to read before going further. Since I am an Apollo investor, I admit my positive bias in what follows.

Mr. Dubitsky lists 7 “key findings”, and I will go through each of them in order. For each finding, I will quote the most important excerpt from the text (not necessarily the full passage) and then provide my commentary. I will follow with conclusions and make some practical suggestions.